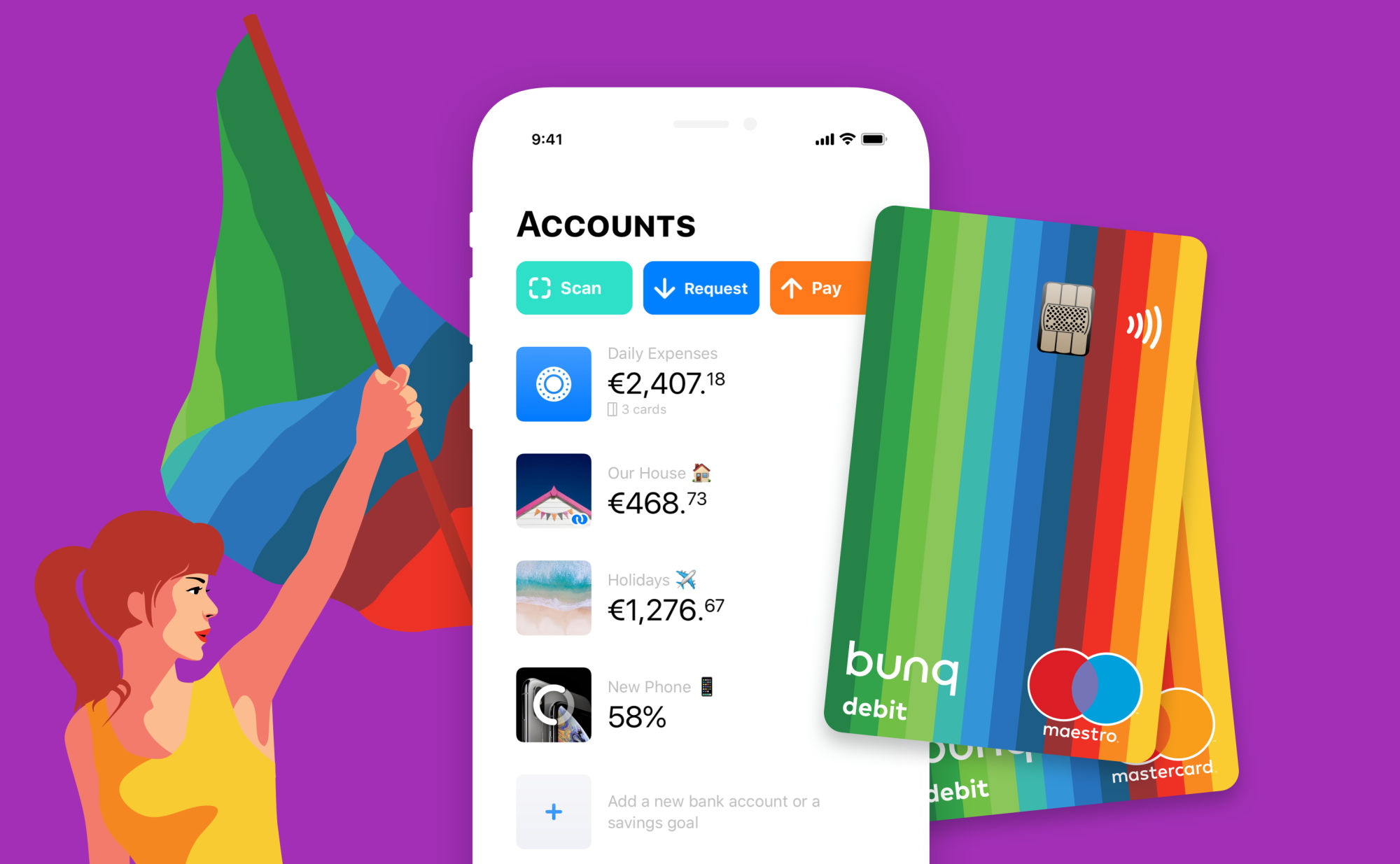

bunq is another of the new digital banks available in Ireland. It is similar to other digital banking services such as Revolut and N26. Bunq has been available in Ireland for a couple of years – but in 2022 they started allowing new Irish customers to have an Irish IBAN.The advantage of N26 is that the analytics is significantly better. In summary, bunq has far greater potential and flexibility to manage monthly spending, (and saving), but N26 handles spending analysis much better.They both have good features. N26 is cheaper but offers more features. And the premium options of N26 are more expensive than the premium options of Revolut.

Is there anything better than Revolut : Many of the alternatives offer competitive or even better rates than Revolut for international money transfers. Platforms like Wise and Starling Bank, for instance, provide mid-market exchange rates and low fees, making them excellent options for international transactions.

Is Revolut still the best

Low cost and easy to use, Revolut is among the top digital-only financial providers for regular travellers and those sending money overseas. It comes with a transparent fee structure and transfers are safe and secure.

Is my money safe with bunq : Thanks to our European banking license given by the Dutch National Bank (DNB), all deposits from verified users are automatically insured up to €100,000 by the Dutch Deposit Guarantee Scheme (DGS). In the unlikely event of anything happening to bunq, you can rest assured your money is safe.

We Recommend N26 for

✅ Self-employed workers and freelancers in the EU can easily manage their finances with N26 digital banking. ✅ Those who often travel or are digital nomads will benefit from spending with payment cards without foreign exchange fees.

We have client accounts with a range of large banks (that meet our and our regulator's requirements). Safeguarding protects you because, if Revolut was to become insolvent, the money in these accounts would be used to pay out you (and our other customers) before anyone else.

What is the downside of Revolut

On the downside, it doesn't offer popular asset classes like mutual funds, bonds or options.. Research and educational tools are very basic, and customer support only answers some basic questions. Also, Revolut has had some quite negative news coverage recently.Bunq's top competitors include Monese, Finom, and Lunar. Monese serves as a financial technology company offering a money app as an alternative to traditional banking. The company provides instant mobile money accounts, multi…As of January 2024, bunq offers one of the highest interest rates on savings accounts for no fee. Creating a savings account at bunq bank is free and can even be done on an "Easy Investments" account without a monthly subscription cost.

Instarem is The Answer. Among Revolut alternatives, some of them offer low-cost transfer fees and competitive exchange rates. However, there is one provider that is second to none, namely Instarem. Aside from the low-cost fees, Instarem also grants you extra rewards.

What are the disadvantages of using Revolut : On the downside, it doesn't offer popular asset classes like mutual funds, bonds or options.. Research and educational tools are very basic, and customer support only answers some basic questions. Also, Revolut has had some quite negative news coverage recently.

Can I use Revolut as a German bank account : Yes, Revolut is available in a wide range of countries in the European Economic Area (EEA), including Germany. ¹ This means you can download and use the mobile app, transfer money, open an account and use your Revolut card to spend throughout Germany.

Is Revolut losing money

The company, which became the UK's most valuable fintech firm in 2021, detailed the loss in its delayed annual report on Friday, marking a return to the red after reporting its first-ever annual pre-tax profit – worth £39m – a year earlier.

There are plenty of reasons why it might be worth signing up for Revolut account, like: – Global transfers with competitive exchanges rates – Fast and secure transactions – Multi-currency accounts that let you hold a range of currencies at once – Budgeting and analytics features to track your habits – Safety features …Although Revolut is authorised by the Financial Conduct Authority under electronic money (e-money) regulations it does not have a banking licence in the UK. This means customers' money is not automatically protected by the Financial Services Compensation Scheme.

Is Revolut 100% safe : Almost all deposits made by people and businesses with Revolut Bank UAB are protected by the state company Deposit and Investment Insurance. This means, if Revolut Bank UAB can't repay deposited money, the Deposit and Investment Insurance company will repay it to the depositors.